Using Your SMSF to Buy Property

By far one of the main reasons people consider opening a Self Managed Super Fund is to allow them to purchase an investment property. Over the past decade the number of fund’s being opened has increased significantly as more people make the conscious decision to take control of their retirement savings.

Investing in residential property inside a self managed super fund can offer significant benefits to investors of all ages. Among these are the ability to enter the property market sooner than would otherwise be possible for young people, the considerable tax advantages and the ability to invest in a tangible asset.

Gearing can be an effective way of gaining access to this asset class both inside and outside of super, but it’s not for everyone.

Investing In Property – The Benefits

Residential property can produce stable, long-term returns across most economic cycles. The expectation of reduced interest rates for longer and increasing rental incomes makes the current market attractive to potential investors.

On the tax side, you can use concessionally taxed money, such as your employer’s compulsory 9.5% super contributions or salary sacrifice, to cover any loan repayments for a property within super. In this environment, rental income and capital gains are taxed at a maximum of 15% (10% capital gains tax is paid if the property is held for more than 12 months). This rate drops to 0% once your SMSF is in pension phase subject to certain account balance limits under legislation.

A major attraction of purchasing property in your SMSF is that it can allow you to have exposure to the property market with little impact on your personal disposable income, with super contributions and rental income funding the investment over time.

Is It Right For You?

Investing in a lumpy asset, especially combined with gearing, is not suitable for everyone. You should consider your risk profile, years to retirement and level of super contributions to determine whether you should go ahead in the first place and then work out the value of the property and level of gearing you can afford.

Gearing is risky!!! Specialist cash flow, investment and tax advice is required in this area.

While it can increase the potential returns, the potential losses are also magnified. Your risk tolerance will determine the appropriate level of gearing. For example, if you’re an aggressive investor, you may be able to afford to borrow the maximum amount because you can afford to accept moderate falls in capital value. If you’re a conservative or moderately conservative investor, you may not consider gearing at all to preserve your capital value.

Can You Afford To Service The Loan?

Your periodic servicing costs, which include paying principal and interest and any other property expenses, will depend on the number of years to retirement, when the loan should be completely paid off. A longer timeframe will result in lower annual servicing costs while a shorter timeframe will increase the annual costs. For example, assuming annual property expenses of $3,500, and interest of 7% on a $200,000 loan, your SMSF will have annual outgoings of approximately $22,379 over 20 years or $31,976 over 10 years.

While rental income will partly offset the servicing cost, most of the cost will be met by your super contributions if the property is highly geared, so it’s vital your contributions are sufficient to cover the cost easily. Otherwise when things get tight, you may be forced to sell the property at unfavourable prices. You also need to consider the limits placed on concessional contributions as this will restrict the amount of cash flowing into your fund to service the loan.

Now let’s consider an example of how a typical residential property purchase may look inside an SMSF.

Peter And Lauren Buy a Good Yielding Property

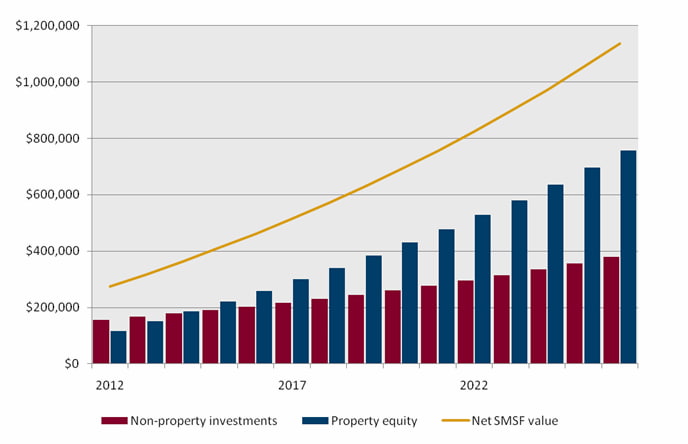

Peter and Lauren established their own SMSF in 2012 and their total member balances are $300,000. They planned to make combined concessional contributions of $40,000 pa to their SMSF over a 15 year period of time, at which point they planned to retire.

A good quality decent yielding property has been sourced through expert research and independent advice. It’s valued at $500,000 and is located within close proximity to schools, shops, medical facilities and public transport. It has four bedrooms, two bathrooms and two car spaces. The current rent on the property is $530 per week.

Peter and Lauren consider themselves to be aggressive investors. They are happy to accept capital losses in the short term to achieve higher potential returns over the long term. Based on their retirement age and their contribution level, they can afford to borrow up to 80% of the property’s value, equivalent to a loan of $400,000.

Peter and Lauren will need to use around $143,000 from their SMSF to pay for the deposit and upfront costs of purchasing the property. This leaves $157,000, or just over half of their SMSF’s initial value, to invest and diversify into other assets such as Australian shares, Asian shares and resources.

Assuming rent, property value and the rest of the SMSF’s investment portfolio grows at a conservative 3% per year, the total value of their SMSF is estimated to reach $1.1 million by the time they retire.

In this example, if Peter and Lauren’s planned retirement age was sooner or they couldn’t afford to contribute $40,000 per year, then the property value or gearing level would have to reduce. All these factors are crucial to the success of the strategy.

Get Advice Before Going Ahead

Like all financial strategies, talk to your advisor about how this type of investment strategy might work best for you. A specialist property investment advisor can help you determine if the investment is right for your circumstances and your financial advisor can help you determine if it fits with your overall financial goals.

General Advice Warning

The information contained in the above blog is general in nature, your specific circumstances have not been taken into account and no recommendation should be implied or has been made by the author.

Past Performance Is Not a Guarantee of Future Returns

Investing in property and other growth asset classes (particularly new products released to market) carries risk of capital loss and fluctuation of capital value depending on prevailing economic conditions. The reader should not draw the conclusion that investing in property via a Self-Managed Superannuation entity is appropriate for them or that this tax structure is suitable without first seeking specialist advice.

You should not act on any information without seeking professional advice from your adviser, broker, tax agent, solicitor or other specialist in this area.