Learn Our System To Maximise Your Deduction Claims

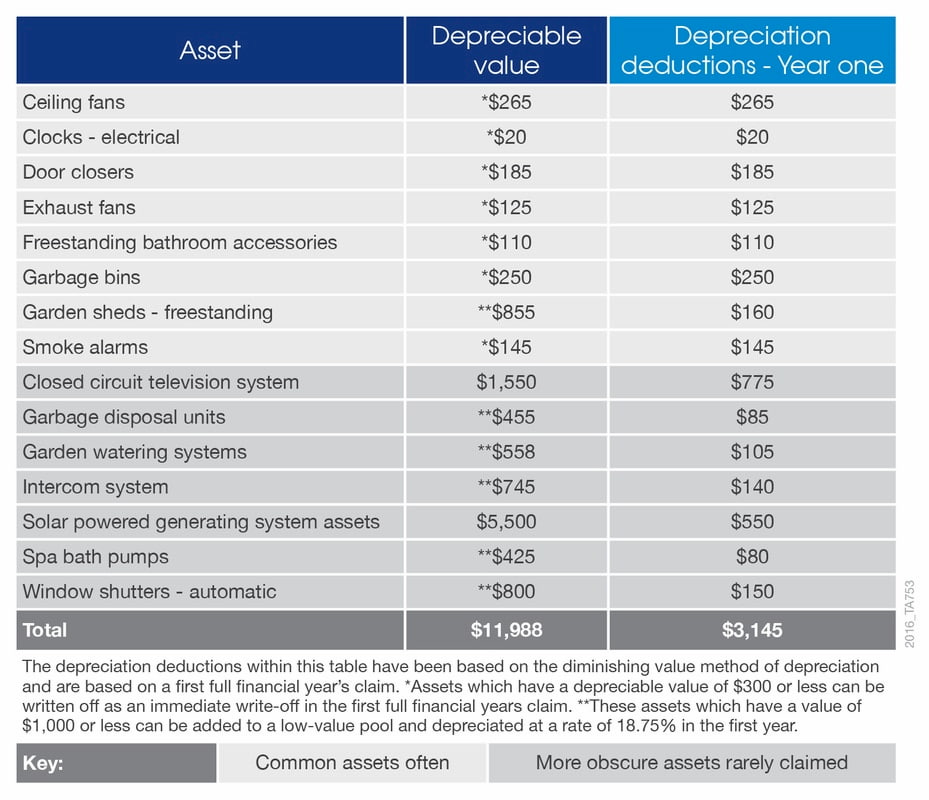

Closed circuit television systems, garden watering systems, intercom systems and solar powered generating system assets are all assets which are often missed by property investors when claiming depreciation.

These and other missed assets such as door closers, freestanding bathroom accessories, garbage bins, shower curtains and smoke alarms are part of a list we have compiled to help investors avoid missed depreciation deductions.

Although many of these items have a low depreciable value, as shown in the following table, the depreciation deductions which can be claimed for these items can add up to thousands of dollars for an investor.

So here’s our system to help investors ensure no item is missed and to maximise their depreciation deductions:

So here’s our system to help investors ensure no item is missed and to maximise their depreciation deductions:

- Take note of the assets included in the above table

- If you have a depreciation schedule and you own any of these assets, confirm with your Accountant that they are included in your schedule and your depreciation claim. If items have been missed, the Australian Taxation Office will allow you to go back and amend the previous two years of missed deductions

- If you don’t have a depreciation schedule you should talk to a specialist Quantity Surveyor as soon as possible

- Ensure your specialist Quantity Surveyor can outline the deductions available for assets which are eligible to be written off immediately or added to the low-value pool

A specialist Quantity Surveyor will use their expert knowledge of tax legislation to ensure the maximum deductions are claimed for each individual asset.

Article provided by BMT Tax Depreciation

Bradley Beer (B. Con. Mgt, AAIQS, MRICS, AVAA) is the Chief Executive Officer of BMT Tax Depreciation. Please contact 1300 728 726 for an Australia wide service.