Free 30 minute consultation to get money smart

To begin with, set a clear limit to the amount that you plan to spend over the next week or two using your credit card. Include in your budget a plan to repay the amount in full, paying as much as possible before the interest kicks in. It’s easy to keep track of expenses when you’re only using one card, so if you have multiple cards, consider taking them out of your wallet or purse and keeping them out of sight during the Christmas period.

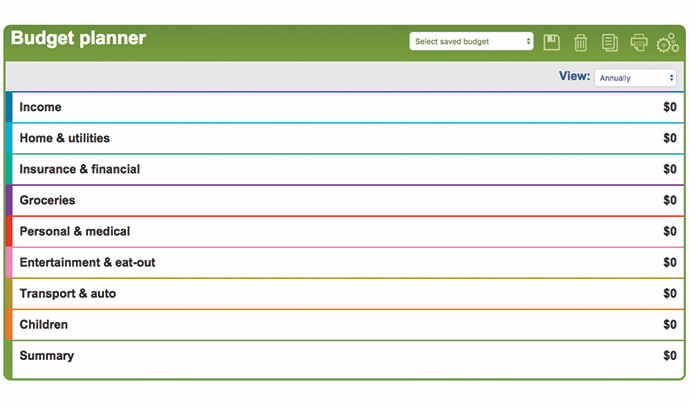

Money Smart’s budget planner makes it easy to track your spend your money over the now that the hectic holiday period is over.

Get 'Money Smart'

A great tool I often recommend to clients is the online calculator available at Money Smart, which helps you work out where your money is going. You can customise items and save your results online, and even simplify your budget by using the planner. My advice is to print it out and stick it on the fridge so you can clearly see how much money you’re spending and how much you have spare. The key is always over-estimate!

You’ll also find useful and easy to understand information about managing your day-to-day finances, including:

- TrackMySpend smartphone app to track your money and stick within your spending limit

- Saving goals calculator to work out the best way to reach your savings goal

- Problems with debts to help you sort out debts that are spiralling out of control

- Building an emergency fund to create a savings buffer to weather life’s ups and downs

Consolidating debt: a case study

I get inundated with client enquires at the beginning of every new year about debt consolidation. Home loan interest rates are generally lower than the interest rates charged on credit cards or personal loans, so by rolling these debts into your mortgage, the total amount you’re required to pay each month can be reduced.

One client I had a few years ago needed help consolidating the three credit cards he had with three different banks, all of which were used to fund an overseas holiday with his wife. We sat down to go over the budget and quickly worked out they had a surplus of $1,000 per month but had $10,000 in credit card debts. The question was whether to consolidate on their home loan, which would mean a $10,000 increase on the mortgage, or continue to pay the monthly credit card repayments.

To further explain things, that would mean:

We opted to add the credit card debt to the mortgage and then set up a budget moving forward for future holidays and festive periods like Christmas so that none of the above was adversely affected.

Consolidating debt Into your mortgage (low interest)

Consolidating on their mortgage would add to the existing debt, which would initially help with cash flow but ultimately set them both back by about 12 months. That would mean a home loan that was going to take 25 years to pay off would now take 26 ½ years.

Or continue paying high interest rates on your credit cards

Continuing to pay the monthly credit card payments, which would take them around 10 months to wipe the slate clean. Only thing was their daughter was due to star high school, which means higher school fees needed to be factored in.

Smart shopping tips

Here are a few Christmas spending tips to help you save money and avoid getting into debt over the holiday season:

- Shop with cash where possible

- Use a debit card as it takes the money directly from your saving or cheque account without charging interest

- Write a shopping list and stick to it to minimise impulse purchases

- Take the time to compare prices and look for sale items

- Buy food in bulk for parties and shop at local farmers’ markets (in-season produce is usually cheaper)

- Keep track of regular expenses by factoring them into your budget

- Maintain credit card payments, even if that means paying the minimum amount

- I hope these tips help you manage your hard-earned money and prevent you from slipping into unnecessary debt.